Latest Wealth First Portfolio Managers News

Wealth First Portfolio Managers Stock News and Insights: Stay updated with the latest Wealth First Portfolio Managers stock news and industry trends. Access quick information on Wealth First Portfolio Managers stock buybacks,Wealth First Portfolio Managers results, Wealth First Portfolio Managers company analysis, Wealth First Portfolio Managers live prices, Wealth First Portfolio Managers dividends, Wealth First Portfolio Managers bonus share, board meetings, lifetime highs, Wealth First Portfolio Managers targets, lows, and growth stories with AI—all in one place.

Business Standard

Nazara Tech to raise Rs 900 crore; ups stake in Absolute Sports to 91%

Gaming and sports media company Nazara Technologies on Wednesday said its board has approved a preferential equity issue to raise Rs 900 crore. Nazara also announced increasing its stake in Absolute Sports to 91 per cent. The fresh capital will fuel the firm's strategic acquisitions and business expansion, and provide newer growth opportunities, a company statement said. "The preferential equity issue amounting to INR 900 crores will be placed with marquee investors such as SBI Mutual Fund, Junomoneta Finsol (an associate of Plutus Wealth), Think Investments, Discovery Investments, Mithun and Siddharth Sacheti, Cohesion Investments, Chartered Finance and Leasing, Ratnabali Investments and Aamara Capital, further strengthening Nazara's financial foundation for long-term expansion," it said. Nazara acquired an additional 19.35 per cent stake in Absolute Sports, the parent company of Sportskeeda, for Rs 145.5 crores, with 50 per cent of the consideration paid in cash and the remaining

Business Standard

Axis Bank expands wealth management services across 15 new cities

Axis Bank on Monday said its private banking business Burgundy Private will expand its wealth management services to 15 new cities, increasing its presence to 42 locations across India. With this strategic move, Burgundy Private will now offer its bespoke wealth management services tailored to the unique needs of discerning clients in India's rapidly evolving Tier 2 markets, Axis Bank said in a statement. The new locations, to start with, include Bhubaneswar, Patna, Raipur, Agra, Ghaziabad, Jodhpur, Udaipur, Jalandhar, Meerut, Belgaum, Kozhikode, Thiruvananthapuram, Aurangabad, Nagpur, and Gandhidham, it said. By leveraging its expertise, technology, and data analytics, Burgundy Private aims to deliver personalised solutions that meet the evolving expectations of affluent clients in these emerging geographies, it said. Burgundy Private has an AUM of nearly Rs 2.07 trillion, a 33 per cent increase YoY, and currently manages wealth for over 13,000 families across 27 cities.

The Economic Times

Bullish on 3 defensive sectors; going for non-bank financials: Nikhil Rungta, LIC MF

Nikhil Rungta, Co-chief Investment Officer at LIC Mutual Fund, discusses their bullish stance on non-banking financial companies, insurance, and wealth managers. He also highlights positive outlooks for pharma, IT, and FMCG sectors. Rungta notes challenges in the banking sector but sees potential for future growth. Rungta believes that the IT sector has bottomed out with the US election just around the corner and the pickup scene in the BFSI segment.

•

Mon, Sep 16, 2024

CNBC TV18

Bajaj Housing Finance shares double investor wealth, list at 114% premium on BSE, NSE

Beating all estimates in the unlisted market, where shares were said to be trading at a premium of about 107%, Bajaj Housing Finance shares listed at a 114% premium.

Mint

Not a bull market or bear market: Are we in a buffalo market?

Bull markets create wealth and bear markets destroy wealth. But what is a ‘buffalo market’? Find out…

•

Fri, Sep 13, 2024

CNBC TV18

A potential wealth doubler on listing? Bajaj Housing Finance shares to debut on September 16

There is a high possibility as per Street assumption that the Bajaj Group company can be a wealth doubler candidate post listing.

•

Fri, Sep 13, 2024

The Economic Times

LGT Wealth India appoints Poonam Mirchandani as MD of wealth planning & family solutions division

LGT Wealth India has appointed Poonam Mirchandani as the managing director of its wealth planning & family solutions division, effective August 2024. She will focus on advising family business owners, promoters, and high-net-worth individuals, expanding the firm's offerings in succession and estate planning, international wealth management, global mobility, and philanthropy.

•

Wed, Sep 11, 2024

The Economic Times

The Rs 6,560 crore IPO of Bajaj Housing Finance is receiving strong investor interest. As the stock prepares for its market debut next week, top-performing housing finance stocks over the past year include Hudco with a 227% gain, Mehta Housing Finance up 169%, and Parshwanath Corp nearly tripling investors' wealth.

•

Wed, Sep 11, 2024

Business Standard

Allied Blenders & Distillers appoints Anil Somani as CFO

With a distinguished career spanning over 32 years, he brings a wealth of experience and expertise to ABDL; having held prominent finance roles in Fortune 500 companies across sectors including manufacturing, retail, and the Big 4 firms.

Mint

Axis Mutual Fund to launch Nifty 500 Value 50 ETF for long-term wealth creation

Axis Mutual Fund is set to launch a new exchange-traded fund (ETF) that aims to replicate the performance of the Nifty500 Value 50 Index.

•

Tue, Sep 10, 2024

The Economic Times

Jio to global giants scramble for big wealth pile-up of India's rich

India's wealth management sector is booming with local and global companies competing for a share. UBS Group AG is exploring partnerships, while Sanlam Ltd. and Jio Financial Services are entering the market. The sector's growth is driven by rising high-net-worth individuals, asset appreciation, and income growth, despite a talent shortage.

•

Tue, Sep 10, 2024

The Economic Times

Best flexi cap mutual funds to invest in September 2024

Flexi cap mutual funds offer the fund managers the freedom to invest across market capitalisations and sectors/themes. It means the fund managers can invest anywhere based on his outlook on the market. Flexi cap schemes are typically recommended to moderate investors to create wealth over a long period of time. Ideally, one should invest in these schemes with an investment horizon of five to seven years.

•

Tue, Sep 10, 2024

The Economic Times

Why SIP investing for 20 years may not have a multiplier effect on your wealth

The first of a two-part series highlights the pitfalls of passive investing style associated with systematic investment plans. It analyses whether SIPs have potential going forward.

•

Mon, Sep 9, 2024

The Economic Times

Apple's upcoming iPhone will catapult tech trendsetter into age of AI

Apple has sold billions of iPhones since then, helping to create about $3 trillion in shareholder wealth. But in the past decade, there have been mostly minor upgrades from one model to the next - a factor that has caused people to hold off on buying a new iPhone and led to a recent slump in sales of Apple's marquee product.

•

Mon, Sep 9, 2024

The Economic Times

6 midcap mutual funds multiplied investors’ lumpsum investment by 2x in three years

Six midcap mutual funds have doubled investors' lumpsum investments in the past three years. Notable performers include Motilal Oswal Midcap Fund, Quant Mid Cap Fund, and HDFC Mid-Cap Opportunities Fund. These funds delivered impressive returns with Compound Annual Growth Rates (CAGR) ranging from 26.37% to 36.17%, significantly boosting investors' wealth

•

Sun, Sep 8, 2024

The Economic Times

Wealth management and the triple multiplier effect

This growth is underpinned by the ‘Triple Multiplier Effect’ – the confluence of rising High Networth Individuals (HNI) investors, asset appreciation, and savings from incremental growth in income.

•

Sat, Sep 7, 2024

The Economic Times

China bulls getting tired of waiting for elusive stock recovery

Over the past two weeks, long-standing China bulls UBS Global Wealth Management, Nomura Holdings Inc., and JPMorgan Chase & Co. have all downgraded the country’s equities, citing concerns ranging from the property-led demand slump to piecemeal stimulus measures and geopolitical tensions ahead of the US elections.

•

Sat, Sep 7, 2024

The Economic Times

Africa's biggest insurer eyes India wealth management as BlackRock, Jio join fray

“A large number of people are breaking out of the real poverty trap, so they’re able to start focusing on providing for the future,” Sanlam Chief Executive Officer Paul Hanratty said in an interview Thursday. “India is really at that point where a huge chunk of the population are now able to save and invest for the future.”

•

Fri, Sep 6, 2024

Hindustan Times

Ultra-Rich families set to control $9.5 trillion by 2030, Deloitte says

The wealth of ultra-rich families will likely swell to $9.5 trillion by 2030, as family offices grow and morph to rival hedge funds

•

Thu, Sep 5, 2024

Business Standard

Sanlam eyes India wealth management after BlackRock, Jio join contest

Insurer plans to build out its partnership with Shriram Capital Group in India by adding an equal joint venture covering wealth and advice services, doubling down on an initial 2005 investment

•

Thu, Sep 5, 2024

CNBC TV18

PN Gadgil Jewellers fixes price band for IPO — More Details Here

Motilal Oswal Investment Advisors, Nuvama Wealth Management and BOB Capital Markets are the Book Running Lead Managers for the IPO.

•

Thu, Sep 5, 2024

Hindustan Times

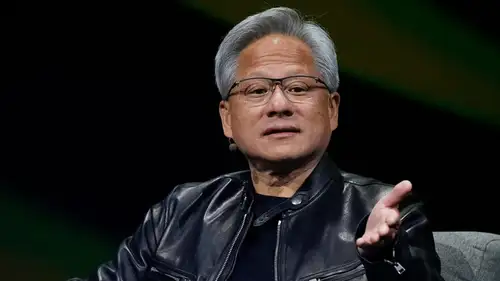

Nvidia’s Jensen Huang loses $10 billion in his biggest wealth wipeout

Nvidia CEO Jensen Huang's net worth dropped $10 billion to $94.9 billion after decline in chip stocks and an antitrust probe by US Justice Department.

•

Wed, Sep 4, 2024

The Economic Times

The article discusses investment strategies for senior citizens like Rajiv Tandon, who seek low-risk monthly income. Alekh Yadav from Sanctum Wealth recommends hybrid funds, such as balanced advantage funds, and systematic withdrawal plans (SWP). These options provide stability and favorable tax treatment. He also suggests considering equity savings funds and new hybrid funds post-Union Budget 2025 changes.

•

Tue, Sep 3, 2024

Business Line

KFin Technologies launches advanced wealth management platform

The platform launch comes as the global ultra-high-net-worth individual population grew by 4.2 per cent to 626,619 in 2023, with projections indicating a 28.1 per cent rise over the next five years

•

Tue, Sep 3, 2024

CNBC TV18

Premier Energies doubles investors' wealth, lists at 120% premium over IPO price

Premier Energies IPO Listing: The stock started trading at ₹990 on the NSE and at ₹991 on the BSE, while its issue price was ₹450.

•

Tue, Sep 3, 2024

Business Standard

Luxury property frenzy set to drive up home prices in India: Poll

Ultra-high-net-worth individuals in India typically own more than two properties, with nearly 12% of them planning to buy another home this year, according to Knight Frank's wealth data

•

Tue, Sep 3, 2024

Mint

Sebi's Buch highlights speed, inclusivity as key drivers for India's market growth

Madhabi Puri Buch, Sebi's chief, emphasized the regulator's focus on speed, aligning with market demands..Buch emphasized inclusivity in India's market growth, introducing a ₹250 monthly investment plan to enable small investors to participate in wealth creation.

•

Mon, Sep 2, 2024

The Economic Times

Wealth Management industry AUM could hit $ 1.8 trillion in next 4-5 years; 360 ONE top pick

In recent years, the assets under management (AUM) in this sector have grown at 15-20% annually, with projections indicating a rise to $1.8 trillion within 4-5 years, reflecting a 13-14% CAGR. This growth is driven by a shift in asset allocation, as investors increasingly move from traditional investments like fixed deposits, gold, and real estate to more dynamic options such as AIFs, REITs, INVITs, private equity, and cryptocurrencies.

•

Mon, Sep 2, 2024

The Economic Times

ASK Private Wealth launches new fund for NRI investors, aims to raise $100 million

ASK Private Wealth has launched the ASK Wealth Advisors India Opportunities Fund, targeting Non-Resident Indians (NRIs) and Overseas Citizens of India (OCIs) (excluding the US and Canada). The fund, aiming to raise $100 million, offers exposure to India's growing capital markets.

•

Mon, Sep 2, 2024

The Economic Times

Ever wondered how a fund manager picks stocks? Learn from the horse's mouth

Charlie Munger believed the key to big returns is patience and conviction in investing. ETMarkets is hosting an online session with Gautam Baid of Stellar Wealth Partners to guide investors on stock selection. Register for the event to enhance your investment strategy.

•

Sat, Aug 31, 2024

The Economic Times

Hurun India Rich List 2024: Gautam Adani tops India’s rich list

Film star Shah Rukh Khan made his debut on the Hurun India Rich list with a wealth of Rs 7,300 crore, fuelled by his stakes in Kolkata Knight Riders and Red Chillies Entertainment Juhi Chawla and family (Rs 4,600 crore), Hrithik Roshan (Rs 2,000 crore), Karan Johar (Rs 1,400 crore), and Amitabh Bachchan (Rs 1,600 crore) are among the others from the film industry.

•

Fri, Aug 30, 2024

Business Standard

'Not in the business of hoarding wealth': Mukesh Ambani addresses 47th AGM

Reliance Industries Chairman Mukesh Ambani addressed the 47th Annual General Meeting, in which he reiterated the company's commitment to the nation's growth

•

Thu, Aug 29, 2024

The Economic Times

Top 10 billionaires added Rs 13.39 lakh crore to net worth in 1 year

Billionaires Gautam Adani and Mukesh Ambani, the top two wealthiest Indians on the 2024 Hurun India Rich List, added Rs 12.54 lakh crore, boosting their total wealth to Rs 35.57 lakh crore.

•

Thu, Aug 29, 2024

Hindustan Times

These are richest zodiac signs in India as per Hurun 2024 Rich List

Cancer, Gemini, and Leo top Hurun India Rich List with significant wealth increases; Cancer sees 84% rise.

•

Thu, Aug 29, 2024

CNBC TV18

IPO stars make their mark on the 2024 Hurun India Rich List

A new wave of wealth has been ushered in by a series of impressive initial public offerings (IPOs), highlighting the growing influence of market successes on India's rich list.

•

Thu, Aug 29, 2024