Latest Bse News

Stay Informed on Bse Stock News: Access the latest Bse stock news, industry updates, and quick information on Bse stock buybacks,Bse results, Bse company analysis, Bse live prices, Bse dividends, Bse bonus share, board meetings, lifetime highs, Bse targets, lows, and growth stories with AI—all in one place.

CNBC TV18

Ion Exchange wins ₹161-crore contract from Adani Power for water and environment solutions

The contracts involve providing comprehensive water and environment management solutions for two 800 MW units at Adani's Raipur and Raigarh ultra-superpower projects. Shares of Ion Exchange (India) Ltd ended at ₹646.35, down by ₹10.45, or 1.59%, on the BSE.

•

Wed, Sep 18, 2024

CNBC TV18

GE T&D India promoters to sell 11.7% stake via OFS at ₹1,400 per share

The floor price of the offer will be ₹1,400 per equity share. The OFS involves up to 11.7% of the company’s equity share capital, which amounts to 30 million shares. Each share has a face value of ₹2. Shares of Ge T&D India Ltd ended at ₹1,705, up by ₹18, or 1.07%, on the BSE.

•

Wed, Sep 18, 2024

CNBC TV18

Garden Reach Shipbuilders bags $54-million German order for four more cargo vessels

Back in June 2024, Garden Reach Shipbuilders and Engineers signed an agreement with Carsten Rehder Schiffsmakler and Reederei GmbH & Co for the construction and delivery of four multi-purpose cargo vessels. Shares of Garden Reach Shipbuilders and Engineers Ltd ended at ₹1,717.25, down by ₹8.40, or 0.49%, on the BSE.

•

Wed, Sep 18, 2024

CNBC TV18

BL Kashyap adds to order book with new ₹221-crore contract in Bengaluru

In June, BL Kashyap secured two big orders totalling roughly ₹1,021 crore. The company's order book, excluding GST, now stands at ₹3,545 crore. Shares of BL Kashyap and Sons Ltd ended at ₹102.05, down by ₹2.15, or 2.06%, on the BSE.

•

Wed, Sep 18, 2024

CNBC TV18

Apollo Micro Systems shortlisted by DRDO for PRACHAND order

The company has also secured a ₹5.72-crore order from Reliable Technosystems India for the supply of electronic modules. Shares of Apollo Micro Systems Ltd ended at ₹109.90, up by ₹3.05, or 2.85%, on the BSE.

•

Wed, Sep 18, 2024

The Economic Times

Stock market update: Mining stocks down as market falls

The 30-share BSE Sensex closed down 131.43 points at 82948.23

•

Wed, Sep 18, 2024

The Economic Times

Stock market update: Sugar stocks down as market falls

The 30-share BSE Sensex closed down 131.43 points at 82948.23

•

Wed, Sep 18, 2024

The Economic Times

Stock market update: Stocks that hit 52-week highs on NSE in today's trade

Euro India Fresh, BSE, Crest Ventures, Silgo Retail and Consol Const., hit their fresh 52-week highs during the day.

•

Wed, Sep 18, 2024

Business Line

Sensex, Nifty close lower amid Fed anticipation; IT sector leads decline

BSE Sensex ends 131.43 points or 0.16 per cent lower at 82,948.23, while the Nifty 50 slipped 41 points or 0.16 per cent to close at 25,377.55

•

Wed, Sep 18, 2024

The Economic Times

Stock market update: FMCG stocks down as market falls

The 30-share BSE Sensex closed down 131.43 points at 82948.23

•

Wed, Sep 18, 2024

The Economic Times

Stock market update: Fertilisers stocks up as market falls

The 30-share BSE Sensex closed down 131.43 points at 82948.23

•

Wed, Sep 18, 2024

Mint

Stock market today: Nifty 50, Sensex slide in choppy trade, IT stocks plummet

The Nifty 50 ended the session with a 0.16 per cent drop at 25,377 points. Likewise, S&P BSE Sensex has also concluded the trade at 82,968 points, a 0.13 per cent lower as compared to the previous close.

•

Wed, Sep 18, 2024

Business Standard

Oracle Financial Services Software Ltd leads losers in 'A' group

Rites Ltd, Mphasis Ltd, Blue Dart Express Ltd and Time Technoplast Ltd are among the other losers in the BSE's 'A' group today, 18 September 2024.

The Economic Times

Multibaggers: 11 stocks gain over 20% in each of the Oct-Dec quarters for the last 4 years

An ETMarkets study revealed 11 stocks listed on the BSE that have consistently gained more than 20% in every October-December quarter over the past four years.

•

Wed, Sep 18, 2024

The Economic Times

ICICI Bank shares hit record high, m-cap tops Rs 9 lakh crore mark

ICICI Bank has crossed the Rs 9 lakh crore market capitalization mark for the first time, reaching a new all-time high on the BSE. The bank's shares have surged nearly 30% this year. Anticipation of an interest rate cut in the US Fed meeting is seen as beneficial for banks and NBFCs.

•

Wed, Sep 18, 2024

Business Standard

Bang Overseas Ltd leads losers in 'B' group

Renaissance Global Ltd, Ecos (India) Mobility & Hospitality Ltd, SpiceJet Ltd and Imagicaaworld Entertainment Ltd are among the other losers in the BSE's 'B' group today, 18 September 2024.

•

Wed, Sep 18, 2024

Business Standard

Sensex slides 200 pts; IT shares slides

At 14:30 IST, the barometer index, the S&P BSE Sensex was down 200.09 points or 0.23% to 82,883.53. The Nifty 50 index fell 76.20 points or 0.30% to 25,342.35.

•

Wed, Sep 18, 2024

Mint

Penny stock under ₹5: Financial stock jumps over 4% after new business adoption move

Penny stock under ₹5: Sunshine Capital share price has fallen over 7% in one week and more than 5% in the past one month. Sunshine Capital is a smallcap stock and commands a market capitalisation of ₹1,260.23 crore on the BSE.

•

Wed, Sep 18, 2024

Business Standard

MCX stock has doubled from June low; up 340% in 16 months; here's why

MCX share price today: MCX hit a new high of Rs 5,966.55 as they rallied nearly 6 per cent on the BSE in Wednesday's intraday trade

•

Wed, Sep 18, 2024

The Economic Times

BSE shares rally 14% to hit fresh record high as NSE IPO rumours gain ground

BSE Share Price: BSE shares surged 14% to a 52-week high amid optimism surrounding NSE's potential IPO, following a recent regulatory relief in the co-location scam. Analysts see this as a re-rating catalyst.

•

Wed, Sep 18, 2024

Business Standard

ICICI Bank's market cap tops Rs 9 trillion; stock hits new high

In one week, the stock of the second largest private sector lender has outperformed the market by gaining 3.5 per cent, compared to the 1.9 per cent rise in the BSE Sensex.

•

Wed, Sep 18, 2024

Business Standard

S.M. Gold Ltd leads gainers in 'B' group

Gautam Gems Ltd, Menon Bearings Ltd, Take Solutions Ltd and MRC Agrotech Ltd are among the other gainers in the BSE's 'B' group today, 18 September 2024.

Business Standard

HEG Ltd leads gainers in 'A' group

Vakrangee Ltd, Graphite India Ltd, Alkyl Amines Chemicals Ltd and Samvardhana Motherson International Ltd are among the other gainers in the BSE's 'A' group today, 18 September 2024.

Business Standard

Bajaj Housing shares slip 6% on profit booking after 2-day run up

Bajaj Housing Finance shares had gained XXX per cent, since listing at a premium of 114%, at Rs 150 on the BSE on Monday

•

Wed, Sep 18, 2024

The Economic Times

Sensex rises! But these stocks are down 5% or more on BSE

In the Nifty pack, 31 stocks were trading in the green, while 19 stocks were trading in the red.

•

Wed, Sep 18, 2024

CNBC TV18

BSE shares surge 80% in less than two months to a record high; More upside in store?

BSE shares had made a low of ₹2,115 on July 23 this year. Since then, the stock has risen 80% from those levels.

•

Wed, Sep 18, 2024

The Economic Times

Stock market update: Stocks that hit 52-week highs on NSE

Euro India Fresh, Silgo Retail, Consol Const., BSE and Heranba Ind, hit their fresh 52-week highs at 11:09AM.

•

Wed, Sep 18, 2024

The Economic Times

Stock market update: Fertilisers stocks down as market rises

The 30-share BSE Sensex was up 160.45 points at 83240.11

•

Wed, Sep 18, 2024

The Economic Times

Stock market update: Power stocks down as market rises

The 30-share BSE Sensex was up 43.55 points at 83123.21

•

Wed, Sep 18, 2024

The Economic Times

Stock market update: Sugar stocks down as market rises

The 30-share BSE Sensex was up 20.1 points at 83099.76

•

Wed, Sep 18, 2024

Business Standard

Motilal Oswal stock jumps 7%; market cap nears Rs 50,000 crore mark

Thus far in the current calendar year 2024, the stock has zoomed 165 per cent, as compared to 15 per cent rise in the BSE Sensex, data shows.

•

Wed, Sep 18, 2024

The Economic Times

Stock market update: FMCG stocks down as market rises

The 30-share BSE Sensex was up 2.89 points at 83082.55

•

Wed, Sep 18, 2024

The Economic Times

Stock market update: Mining stocks up as market falls

The 30-share BSE Sensex was down 13.84 points at 83065.82

•

Wed, Sep 18, 2024

Business Standard

Indices open slightly lower; breadth strong

At 09:30 IST, the barometer index, the S&P BSE Sensex was down 54.63 points or 0.07% to 83,024.97. The Nifty 50 index shed 15.35 points or 0.06% to 25,403.20.

•

Wed, Sep 18, 2024

Mint

Glare on SME IPOs leads to first listing postponement

BSE postponed Trafiksol ITS Technologies' listing due to investor complaints regarding the use of ₹44.87 crore raised. The company must retain the funds in escrow until issues are resolved. Concerns arose from a social media post about questionable financial practices linked to the IPO.

•

Wed, Sep 18, 2024

Business Standard

SpiceJet's Rs 3,000 cr issue commences, floor price set at Rs 64.79 a share

SpiceJet has set a floor price of Rs 64.79 per share for the sale of securities to qualified institutional buyers through which the budget carrier aims to raise up to Rs 3,000 crore. Last week, shareholders approved a proposal to raise up to Rs 3,000 crore. According to the preliminary placement document, a copy of which has been submitted to the BSE, the floor price has been set at Rs 64.79 per share. "Our company may offer a discount of not more than 5 per cent on the floor price in accordance with the approval of the shareholders by way of special resolution pursuant to postal ballot dated on September 13, 2024, and in terms of Regulation 176(1) of the SEBI ICDR Regulations," it said. The shares will be issued only to eligible Qualified Institutional Buyers (QIBs). The no-frills carrier -- which is grappling with multiple woes, including financial challenges, legal battles and grounding of aircraft -- is looking to raise money that will help it meet various obligations. Shares

•

Tue, Sep 17, 2024

CNBC TV18

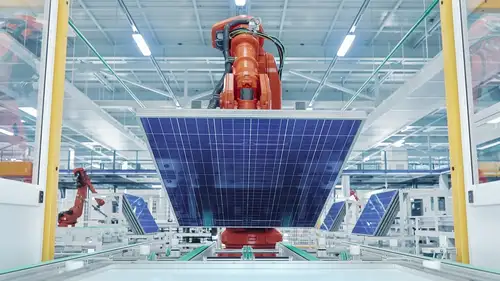

Tata Power’s solar cell unit in Tamil Nadu to be fully functional by October: CEO Praveer Sinha

Praveer Sinha, CEO of Tata Power, also told CNBC TV18 that the company’s 4.3 gigawatt solar module manufacturing plant in Tamil Nadu which has been operational for nearly a year, is now running at full capacity. The Tata Power stock ended 0.39% higher at ₹445 on the BSE today, September 17.

•

Tue, Sep 17, 2024