Insurance Industry News

Stay informed with the latest news on Insurance industry, Insurance stocks, and markets, all in one place.

The Economic Times

Indian refiners using Russian insurance for oil above $60/bbl, govt source says

Indian refiners are using Russian insurance for oil cargoes priced above $60 per barrel, bypassing the G7 price cap. Russian firms insured 60% of these shipments to India in July, up from 40% in December. India is now the top buyer of Russian oil, overtaking China.

The Economic Times

Japan's Nikkei at over two-week closing high as exporters advance on weaker yen

Japan's Nikkei share average reached its highest closing level in over two weeks, driven by exporters as the yen weakened against the dollar. The broader Topix also rose, with significant gains in Toyota and Honda. All industry sub-indexes on the Tokyo Stock Exchange traded higher, with shipping firms and the insurance sector performing strongly.

The Economic Times

Russian insurance shores up oil exports to top buyer India

Russian insurers are increasingly covering oil shipments to India, with 60% of Moscow's oil cargoes insured by Russian firms in July. This shift helps Russia bypass western sanctions and sell oil above the $60 per barrel price cap. India's approval of Russian insurers has bolstered this trend, making it the top buyer of Russian oil.

•

Wed, Sep 18, 2024

Business Standard

Vakrangee jumps after joining hands with Star Health Insurance

Vakrangee rallied 5.59% to Rs 22.11 after the company informed strategic corporate agency tie-up with Star Health & Allied Insurance Co. (Star Health Insurance), to offer health insurance products across its network.

CNBC TV18

LIC, Tata Power, IHCL and more: Top stocks to watch out for on September 18

Top stocks to watch out for on September 18: Life Insurance Corporation of India (LIC), Tata Power, Jupiter Wagons, IHCL and more stocks will be in focus when the markets open on Wednesday.

Business Standard

LIC pares its holding in DCM Shriram Industries by over 2% to 4.66%

Life Insurance Corporation (LIC) on Tuesday said it has pared its stake in DCM Shriram Industries by more than 2 per cent to 4.66 per cent over a period of about three years. In a regulatory filing, LIC said there is a net decrease of 2.016 per cent in its holding in DCM Shriram during the period October 8, 2021, and September 13, 2024. The shares were sold at an average price of Rs 110.072. "...the Life Insurance Corporation of India has decreased its shareholding in equity shares of DCM Shriram Industries Ltd from 58,06,760 to 40,52,635 i.e., 6.675 per cent to 4.659 per cent of the paid-up capital of the said company," LIC said. DCM Shriram Industries is primarily engaged in production and sale of sugar, alcohol and industrial fibres. Shares of DCM Shriram Industries settled 1.77 per cent lower at Rs 194 apiece on the BSE.

•

Tue, Sep 17, 2024

The Economic Times

POSI insurance: A critical coverage for companies eyeing IPOs

Going public is a significant milestone for companies, offering new funding and market expansion but also increased scrutiny. Public Offering of Securities Insurance (POSI) helps protect companies from legal and financial risks during IPOs, ensuring leadership can focus on growth without constant worry about potential liabilities.

•

Tue, Sep 17, 2024

CNBC TV18

RailTel Corporation bags order worth ₹48.7 crore from health insurance company

RailTel Corporation Share Price | The order is for the integrated claims management solution portal and mobile application. It is expected to be completed by June 14, 2030.

Business Standard

Railtel Corp bags Rs 49-crore service order

RailTel Corporation of India informed that it has received a work order from Health Insurance TPA of India for service aggregating to Rs 48.70 crore.

The Economic Times

Goldman Sachs buys 7.4 lakh shares in India Shelter Finance for Rs 56 crore via block deal

Goldman Sachs bought 7.4 lakh shares in India Shelter Finance Corporation through a block deal at Rs 752.35 per share. Other buyers included SBI Life Insurance and ICICI Prudential Life Insurance. Nexus Ventures III Limited and Nexus Opportunity Fund II Limited were the sellers.

•

Mon, Sep 16, 2024

The Economic Times

Sensex, Nifty hit fresh lifetime highs but concede day's gains in range-bound trade

The market saw a near-even split between winners and losers, with 26 stocks closing higher and 24 lower. NTPC, JSW Steel, Hindalco Industries, Shriram Finance, and L&T led the gains, while Bajaj Finance, Hindustan Unilever, Bajaj Finserv, SBI Life Insurance Company, and Britannia Industries saw declines.

•

Mon, Sep 16, 2024

The Economic Times

Bullish on 3 defensive sectors; going for non-bank financials: Nikhil Rungta, LIC MF

Nikhil Rungta, Co-chief Investment Officer at LIC Mutual Fund, discusses their bullish stance on non-banking financial companies, insurance, and wealth managers. He also highlights positive outlooks for pharma, IT, and FMCG sectors. Rungta notes challenges in the banking sector but sees potential for future growth. Rungta believes that the IT sector has bottomed out with the US election just around the corner and the pickup scene in the BFSI segment.

•

Mon, Sep 16, 2024

Business Standard

Infosys collaborates with LIC to accelerate digital transformation

The IT major announced a collaboration with the Life Insurance Corporation of India (LIC) to spearhead its digital transformation initiative called DIVE (Digital Innovation and Value Enhancement).

The Economic Times

LIC picks Infosys to drive digital transformation with NextGen Digital Platform

Infosys has been chosen by Life Insurance Corporation (LIC) to lead its digital transformation with the NextGen Digital Platform. This initiative, called DIVE, aims to provide omnichannel engagement and hyper-personalised experiences for LIC's customers, agents, and employees. Infosys will use its AI and cloud services to enhance LIC's operational capabilities.

•

Mon, Sep 16, 2024

CNBC TV18

Northern Arc Capital IPO opens today: Should you subscribe to the ₹777 crore issue?

Ahead of the issue opening, the company has garnered ₹229 crore from anchor investors, including SBI General Insurance Company, Goldman Sachs (Singapore) Pte, Societe Generale, Quant Mutual Fund, among others.

•

Mon, Sep 16, 2024

Business Standard

90% of financial institutions focus on AI, GenAI for innovation: PwC India

Ninety per cent of Indian financial institutions are focusing on artificial intelligence (AI) and GenAI (Generative Artificial Intelligence) as the primary technology enablers of innovation, according to a PwC India report. As per the PwC India report titled, 'Mapping the FinTech innovation landscape in India' data analytics also continues to emerge prominently across nearly 74 per cent responses, underscoring its integral role in driving insights and decision-making within the financial services (FS) sector. It said that 31 financial institutions consisting of banks, insurance firms and fintechs participated in the survey. "Artificial Intelligence (AI) and GenAI (Generative Artificial Intelligence) emerged as the focus area for innovation for Indian financial institutions, with 90 per cent of the respondents citing them as the primary technology enablers of innovation," it said. Further, 84 per cent of respondents stated that customer experience and engagement - acquisition, ...

•

Sun, Sep 15, 2024

The Economic Times

‘Sachet’ covers now guard against cyber fraudsters using AI

A recent study by Deloitte said that India’s cyber insurance market worth $50–60 million in 2023 is expected to grow at an annual rate of 27–30% in the next five years.

•

Sat, Sep 14, 2024

The Economic Times

High premium costs for parametric insurance flagged at NDMA meet amid GST concerns

The National Disaster Management Authority (NDMA) discussed the high cost of parametric insurance premiums and the imposition of 18 percent GST on insurance premiums. The meeting focused on expanding parametric insurance, particularly for extreme heat, and finding ways to finance premiums for disadvantaged groups. The NDMA also plans a workshop on disaster risk insurance in September 2024.

•

Fri, Sep 13, 2024

The Economic Times

Ayushman Bharat enrollment for senior citizens to start in a week

Enrollment for senior citizens aged 70 and above under the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) will begin soon. Initially launching as a pilot program, eligible seniors can apply through the Ayushman mobile app or PMJAY portal. The scheme offers free health insurance coverage of up to Rs 5 lakh annually on a family basis.

•

Fri, Sep 13, 2024

Hindustan Times

Berkshire Hathaway's Ajit Jain sells more than half his stake in the company

Ajit Jain, Berkshire Hathaway's vice chair of insurance operations, sold $139 million in Class A shares, retaining 166 shares.

•

Fri, Sep 13, 2024

The Economic Times

ET Startup Awards 2024 | Best on Campus: ClaimBuddy stays on pulse to take home campus star prize

The startup that provides digital infrastructure to hospitals for processing insurance claims and assists patients in getting faster pay-outs was praised for its mission to improve a massive pain point for users.

•

Fri, Sep 13, 2024

CNBC TV18

LIC raises stake in IRCTC to 9.3% through open market purchases

Shares of Life Insurance Corporation of India Ltd ended at ₹1,031.45, up by ₹18.35, or 1.81% on the BSE.

Business Standard

DGCA frames stricter norms for wet-leased plane ops by Indian airlines

The Directorate General of Civil Aviation (DGCA) on Thursday proposed stricter norms for the oversight of wet-leased planes operated by Indian airlines. Faced with the grounding of a significant number of planes due to engine and supply chain woes, domestic carriers are utilising more wet-leased aircraft as a short-term measure to cater to rising air traffic demand. The watchdog has issued a draft for public consultation on the revised Civil Aviation Requirements (CAR) on wet/damp lease operations by Indian operators to strengthen the regulatory framework for safety oversight of wet/damp lease operations. Wet lease of an aircraft by an Indian carrier involves the leasing of foreign aircraft, along with crew, maintenance and insurance. The plane is also under the operational control of the foreign operator (lessor) and subject to regulatory requirements of the foreign civil aviation authority concerned. The safety oversight of such operations is also under the purview of the foreign

•

Thu, Sep 12, 2024

Business Line

Western Carriers secures ₹148 crore from anchor investors ahead of IPO

The Kolkata-based company aims to generate around ₹493 crore from the public offer, with anchor investors such as Aditya Birla Sun Life Insurance, Kotak Mahindra Life Insurance, and others showing significant interest

•

Thu, Sep 12, 2024

Business Standard

Indian Oil to provide scholarships, medical insurance to para athletes

Public Sector Undertaking (PSU), Indian Oil Corporation on Thursday promised to provide monthly scholarships and medical insurance to the country's para athletes after their stupendous show at the just-concluded Paris Paralympics. The Indian contingent made history by securing 29 medals, including seven gold, nine silver and 13 bronze, marking the nation's best-ever performance at the Paralympics in Paris. Pankaj Jain, secretary, Ministry of Petroleum and Natural Gas, expressed his admiration for the para athletes and announced that Indian Oil will be further enhancing its support by introducing monthly scholarships, medical insurance, and sports kits for para athletes. "This historic performance is a testament to the resilience and determination of our para athletes," V Satish Kumar, Chairman and Director (Marketing), IndianOil, said during a felicitation function here on Thursday. "IndianOil is proud to have supported them on this incredible journey, and we remain committed to ..

Business Standard

Peak XV Partners, 4 others sell stake worth Rs 1,601 cr in Honasa Consumer

Peak XV Partners (formerly Sequoia Capital India & SEA), and four others on Thursday divested a 10 per cent stake in Honasa Consumer, which owns Mamaearth brand, for Rs 1,601 crore through open market transactions, while ICICI Prudential Life Insurance and Morgan Stanley acquired stakes in the company. Peak XV Partners through its arm Peak XV Partners Investments VI, Fireside Ventures through its affiliate Fireside Ventures Investment Fund I, Sequoia Capital Global Growth Fund III-US/ India Annex Fund, Sofina and Stellaris Venture Partners India I sold more than 3.23 crore shares or 10 per cent stake in Honasa Consumer, as per the data. According to the bulk deal data available on the National Stock Exchange (NSE), Peak XV Partners sold over 1.23 crore shares or 3.81 per cent stake in Honasa Consumer and Fireside Ventures offloaded 65.83 lakh shares or 2.03 per cent stake in Gurugram-based company. In addition, Brussels-headquartered Sofina Ventures SA divested 60.15 lakh shares ..

•

Thu, Sep 12, 2024

Business Standard

LIC increases stake in railway sector 'miniratna' PSU IRCTC to 9.3%

Life Insurance Corp (LIC) on Thursday said it has hiked its stake in Indian Railway Catering and Tourism Corporation (IRCTC) to about 9.3 per cent. In a regulatory filing, LIC said its holding in railway sector 'miniratna' PSU has increased 2.02 per cent in the period December 16, 2022, to September 11, 2024, via open market purchases. "Life Insurance Corporation of India has increased its shareholding in equity shares of Indian Railway Catering and Tourism Corporation Ltd from 5,82,22,948 to 7,43,79,924 i.e., 7.278% to 9.298% of the paid-up capital of the said company (IRCTC)," LIC said. Shares of LIC closed at Rs 1031.45, up 1.81 per cent over the previous close on the BSE.

•

Thu, Sep 12, 2024

Business Standard

LIC increases stake in railway sector 'miniratna' PSU IRCTC to 9.3%

Life Insurance Corp (LIC) on Thursday said it has hiked its stake in Indian Railway Catering and Tourism Corporation (IRCTC) to about 9.3 per cent. In a regulatory filing, LIC said its holding in railway sector 'miniratna' PSU has increased 2.02 per cent in the period December 16, 2022, to September 11, 2024, via open market purchases. "Life Insurance Corporation of India has increased its shareholding in equity shares of Indian Railway Catering and Tourism Corporation Ltd from 5,82,22,948 to 7,43,79,924 i.e., 7.278% to 9.298% of the paid-up capital of the said company (IRCTC)," LIC said. Shares of LIC closed at Rs 1031.45, up 1.81 per cent over the previous close on the BSE.

•

Thu, Sep 12, 2024

The Economic Times

General insurance growth slows to 4.5% in August amid slower auto sales

The general insurance industry experienced a modest 4.5% growth in August 2024, hindered by slower vehicle sales and no motor third party tariff hike. Standalone health insurers reported robust growth, with Niva Bupa Health Insurance leading the way. ICICI Lombard and Go Digit General Insurance saw increases in premiums, while New India Insurance and National Insurance faced declines.

•

Thu, Sep 12, 2024

The Economic Times

LIC hikes stake in IRCTC to 9.3%

Life Insurance Corp (LIC) on Thursday said it has hiked its stake in Indian Railway Catering and Tourism Corporation (IRCTC) to about 9.3 per cent. In a regulatory filing, LIC said its holding in railway sector 'miniratna' PSU has increased 2.02 per cent in the period December 16, 2022, to September 11, 2024, via open market purchases.

•

Thu, Sep 12, 2024

The Economic Times

Companies should provide health insurance to all employees: GIC head

The head of the General Insurance Council has proposed expanding health insurance by mandating employer-provided coverage, using CSR funds for premiums, and integrating corporate health insurance with state plans. These measures aim to increase insurance penetration and stimulate economic growth through enhanced healthcare infrastructure.

•

Thu, Sep 12, 2024

The Economic Times

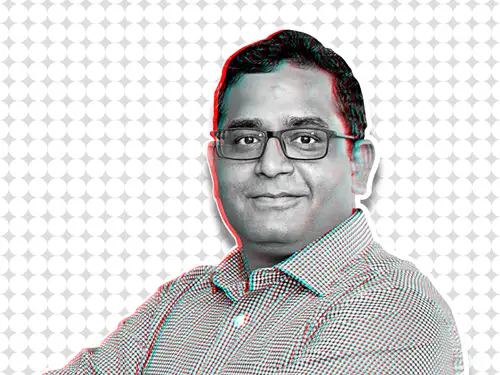

Paytm aims for profitability with 'compliance-first' approach: Vijay Shekhar Sharma at AGM

Paytm founder Vijay Shekhar Sharma announced at the company's 24th annual general meeting that they aim to achieve profitability soon. The company will strictly adhere to regulatory guidelines and adopt a compliance-first approach. Paytm plans to expand its merchant network and build cross-sell capabilities around financial services like loans, mutual funds, and insurance products.

Business Standard

HDFC Life Insurance Company Ltd down for fifth straight session

HDFC Life Insurance Company Ltd is quoting at Rs 700.55, down 0.33% on the day as on 13:19 IST on the NSE. The stock jumped 5.99% in last one year as compared to a 25.32% rally in NIFTY and a 16.42% spurt in the Nifty Financial Services index.

The Economic Times

Ashish Kacholia-backed smallcap stock surges 20% in 2 days, hits 52-week high; here's why

Shares of smallcap firm Zaggle Prepaid Ocean Services, supported by ace investor Ashish Kacholia, surged 20% over the past two trading sessions on the BSE, reaching a 52-week high of Rs 420. This rally followed the company's announcement of a new partnership with HDFC Ergo General Insurance Company.

•

Wed, Sep 11, 2024