Paints Industry News

Access all the essential Paints industry, Paints stocks, and market updates in one spot.

Business Line

JK Cement to invest ₹3,000 crore in major capacity expansion

The company plans diversification into paints and building materials, according to Dr Raghavpat Singhania, its Managing Director

•

Tue, Sep 17, 2024

The Economic Times

How these paints, FMCG, and IT stocks can save your portfolio in a bear market

Quality stocks like Marico, Asian Paints, HUL, Berger Paints, ITC, Nestle India, Dabur, and Page Industries have underperformed the benchmark indices from 2020 to date. Even their PE multiples have fallen. But analysts believe these companies are attractive. Here’s why.

•

Mon, Sep 16, 2024

The Economic Times

Can Akzo Nobel maintain growth in a volatile paint industry? Rajiv Rajgopal answers

We are focused on that at this point of time and between all our verticals of paints and coatings, we are trying to make sure we do it. How are we going about it? You may have just read. We have just announced an addition of 5,000 tonne capacity in our Gwalior for our powder business, that is one of our fast growing business and now with the capacity augmented at Gwalior, we should be able to serve our customers, particularly in the northern and eastern part of the country and the team is doing a fabulous job.

•

Mon, Sep 16, 2024

CNBC TV18

Bonus shares, dividend : Check record dates for Asian Paints, Phoenix Mills, Mazagon Dock and more

Asian Paints, Mazagon Dock Shipbuilders, Bombay Metrics Supply Chain and others have announced bonus issue and/or dividend for their shareholders. Take a look at the record dates for the announcements

•

Fri, Sep 13, 2024

Mint

Asian Paints sets board meeting date to consider dividend, sets record date

Asian Paints announced a board meeting on October 23, 2024, to review financial results and consider an interim dividend. The record date for the dividend payment is set for October 31, 2024.

•

Fri, Sep 13, 2024

CNBC TV18

Sensex Today | Stock Market LIVE Updates: As many as 33 Nifty 50 stocks are trading in the red, while 17 stocks advance. Asian Paints (-1.45%), Divi's Labs (-1.21%) and SBI Life (-0.98%) are the top index losers at this hour. On the other hand, Tata Steel (1.48%), Wipro (1.29%) and JSW Steel (1.17%) are the top gainers.

•

Fri, Sep 13, 2024

Business Standard

5 stocks to buy and sell as crude oil prices drop to $70 a barrel

Here's a technical outlook on stocks linked to crude oil prices, which is down 23% from its peak and trades near 3-year lows. Among stocks, Asian Paints and MRF look favourable on charts; here's why.

•

Thu, Sep 12, 2024

The Economic Times

ONGC, Oil India shares slip up to 6% on falling crude prices. Here is what analysts say

Oil India Share Price: Shares of ONGC and Oil India fell sharply on BSE due to a significant drop in crude oil prices, influenced by OPEC's revised demand forecasts. The decline in oil prices impacts the profit margins of these companies. However, sectors like paints, airlines, and FMCG may benefit from lower crude prices.

Business Line

Kamdhenu Paints to launch wood coatings, boost production capacity

The company’s strong performance in previous fiscal years, coupled with the well-received Dual Emulsions Series, has positioned it for further expansion, as evidenced by the opening of a new office in Gurugram

•

Mon, Sep 9, 2024

CNBC TV18

Analysts suggest buying ACC, Coforge, Asian Paints and selling Canara Bank, GAIL, BOB

Market tech analysts Soni Patnaik, Mitessh Thakkar and F&O analyst Chandan Taparia have these recommendations on Monday.

•

Mon, Sep 9, 2024

Business Line

Stocks that will see action today: September 9, 2024

Buzzing stocks: Ola Electric, Jio Financial, HUL, Shriram Fin, Adani Enterprises, Signature Global, Ahluwalia Contracts, Tata Power, SpiceJet, Metro Brands, Godfrey Phillips, Indigo Paints, Suzlon, Au Small Finance, Nykaa, Wardwizard Innovations, Mazagaon Doc, Seven Pharma, Ami Organics

•

Mon, Sep 9, 2024

The Economic Times

Peak XV Partners, formerly Sequoia Capital India and SEA, sold over 22% stake in Indigo Paints for Rs 1,557 crore to investors including Morgan Stanley, Mercer, and HDFC MF. The shares were sold via open market transactions. Following the sale, Indigo Paints' shares fell by 4.19% on the NSE.

•

Fri, Sep 6, 2024

Business Standard

Peak XV Partners sells 22% stake in Indigo Paints for Rs 1,557 crore

Peak XV Partners, formerly Sequoia Capital India and SEA, on Friday, divested a little over 22 per cent stake in Indigo Paints to investors like Morgan Stanley, Mercer and HDFC MF for Rs 1,557 crore via open market transactions. Venture capital firm Peak XV Partners through its two affiliates, Peak XV Partners Investments IV and Peak XV Partners Investments V, offloaded a total of 1.05 crore shares, amounting to a 22.04 per cent stake in Pune-headquartered Indigo Paints, as per the bulk deal data on the NSE. The shares were sold in the price range of Rs 1,475.96-1,489.35 apiece, taking the transaction value to Rs 1,557.05 crore. After the latest transaction, the shareholding of Peak XV Partners Investments IV has declined to 1.54 per cent from 12.14 per cent, while Peak XV Partners Investments V's stake has come down to 1.65 per cent from 13.09 per cent. Meanwhile, HDFC Mutual Fund (MF) acquired 10.04 lakh shares or 2.11 per cent of Indigo Paints, New York-based consulting firm Mer

•

Fri, Sep 6, 2024

Mint

Ganesh Chaturthi pick: Sumeet Bagadia suggests this paint stock to buy

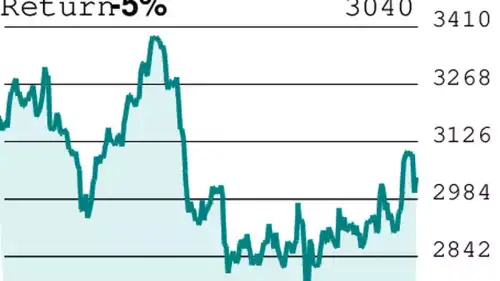

'Asian Paints is currently trading at ₹3244 and has formed a symmetrical triangle pattern on the monthly chart with significant volume, indicating a strong bullish trend,” the brokerage firm said in a note

•

Fri, Sep 6, 2024

Business Standard

Volumes jump at Indigo Paints Ltd counter

Indigo Paints Ltd saw volume of 236.18 lakh shares by 14:14 IST on NSE, a 139.79 fold spurt over two-week average daily volume of 1.69 lakh shares

•

Fri, Sep 6, 2024

CNBC TV18

Indigo Paints sees 25% equity change hands in likely cleanout trade

Indigo Paints Share Price | On Thursday, September 5, sources told CNBC-TV18 that Peak XV Partners launched a block deal to offload an 11% stake in the Pune-based company. Sources said the offer price for the shares was set at ₹1,470 per share and the total deal size was valued at ₹770 crore.

•

Fri, Sep 6, 2024

CNBC TV18

Indigo Paints Block Deal: Peak XV Partners likley to sell 11% stake for ₹770 crore

Shares of Indigo Paints Ltd ended at ₹1,538.30, up by ₹1.90, or 0.12% on the BSE.

•

Thu, Sep 5, 2024

CNBC TV18

stocks to watch, Wipro, Ashoka Buildcon, Sundaram Clayton, Jindal Stainless, Finolex Cables, Reliance Industries, Udayshivakumar Infra, Venus Pipes, Indigo Paints, Adani Enterprises, Nucleus Software, Pidilite Industries, KEC International and and more, these are the stocks to watch for today.

•

Thu, Sep 5, 2024

Mint

Paint stocks surge up to 6% as crude oil prices plunge; Asian Paints hits 8-month high

Brent and WTI crude oil futures each fell more than 5 percent on Tuesday, reaching a nine-month low due to reduced demand signals from China and reports of a potential deal to resolve a dispute that has disrupted Libyan production and exports.

•

Wed, Sep 4, 2024

CNBC TV18

Crude Oil Prices Fall — HPCL, Asian Paints shares surge but selling pressure in ONGC, Oil India

Find out why OMCs are gaining in today's session but ONGC and Oil India are seeing selling pressure due to the fall in crude oil prices.

•

Wed, Sep 4, 2024

Business Line

Sensex, Nifty updates on 4 September 2024: Indian stock markets ended Wednesday’s session with mixed results, as the Nifty 50 index briefly touched a new all-time high before retreating due to profit-taking in the final hour. The BSE Sensex closed down 202.80 points or 0.25 per cent at 82,352.64, while the Nifty 50 fell 81.15 points or 0.32 per cent to 25,198.70, breaking a 14-day winning streak. The day’s trading was characterized by volatility, with the Nifty opening lower at 25,089.95 but recovering throughout the session. Sector-wise performance was mixed, with pharma, realty, and FMCG sectors seeing gains, while IT and metal sectors faced profit-taking. Srikant Chouhan, Head of Equity Research at Kotak Securities, commented on the market’s performance, saying, “Today, on the backdrop of weak global sentiment benchmark indices witnessed profit booking at higher levels... Technically, post gap down opening market registered a pullback rally. From the day, lowest point market recover over 130/550 points.” Among the top gainers on the NSE were Asian Paints (2.50 per cent), Grasim (1.91 per cent), Hindustan Unilever (1.71 per cent), Ultratech (1.23 per cent), and Sun Pharma (1.19 per cent). The top losers included Wipro (-3.06 per cent), Coal India (-2.81 per cent), ONGC (-2.27 per cent), Hindalco (-1.90 per cent), and LTIMindtree (-1.15 per cent).

•

Wed, Sep 4, 2024

The Economic Times

Benchmark equity index Nifty50 hit a record peak of 25,129.6 on Wednesday, slightly closing higher than the previous day, driven by gains in IT stocks. Sensex closed at 81,785, gaining 74 points. LTIMindtree, Wipro, Divi's Labs, Bharti Airtel, and Infosys were top gainers, while Maruti Suzuki and Asian Paints lagged.

•

Wed, Aug 28, 2024

Business Standard

Grasim achieves highest-ever Ebitda of Rs 20,837 cr: Kumar Mangalam Birla

Speaking at the company's 77th Annual General Meeting, Kumar Mangalam Birla said that Grasim Industries invested Rs 7,000 crore in its paints business

•

Wed, Aug 21, 2024

The Economic Times

Asian Paints, Cummins India among 4 stocks with short covering

Short covering signals a shift from extreme bearishness to bullishness.

•

Wed, Aug 14, 2024

Business Standard

Keeping close watch on competition, says Berger Paints India MD & CEO

Roy's comments come in the wake of the entry by the Aditya Birla group into the decorative paints segment

•

Mon, Aug 12, 2024

Business Standard

Berger Paints eyes 5% value growth in Q2, targets doubling turnover by 2029

Coating major Berger Paints India Ltd has implemented three price hikes since June, which are expected to boost its 'value' growth to around 5 per cent in the second quarter ending September 2024, while maintaining a volume growth target of at least 10 per cent, an official said on Monday. Speaking after the company's 100th AGM, Berger revealed that its next milestone is to double its turnover to Rs 20,000 crore by 2029, up from Rs 10,000 crore in FY2024. The company also plans to close down the Howrah plant and convert it into a larger R&D centre by the end of 2025, once the greenfield Panagarh facility in West Bengal becomes operational. "We achieved a volume growth of 11.8 per cent in Q1 of FY2025, but value growth was just 2.5 per cent due to factors like price decreases, reduced raw material costs, and a slowdown in the luxury paints segment in West Bengal and Kerala. "The three price hikes between June and August will improve and mitigate the cost impact of 1.5 per cent, ...

•

Mon, Aug 12, 2024

Business Line

F&O Strategy: Asian Paints: Buy put option

As the market lot is 200 shares, this would cost ₹10,250

•

Sat, Aug 10, 2024

Business Line

Berger Paints reports marginal decline in Q1 net profit to ₹354.03 crore

The company said the first quarter of this fiscal was “tough” due to elections, inclement weather and slowdown in a few key markets

•

Fri, Aug 9, 2024

Business Line

Berger Paints enhances network connectivity with HPE Aruba’s SD-WAN solution

The implementation aims to improve application availability, user experiences, and overall network performance

•

Fri, Aug 9, 2024

Business Line

Movers & Shakers: Stocks that will see action this week

Here is what the charts say about the shares of Cigniti Technologies, Kansai Nerolac Paints and Senco Gold

•

Sat, Aug 3, 2024

Business Line

Stock to buy today: Berger Paints India (₹552.6)

Liquidate the longs at ₹575

•

Fri, Aug 2, 2024

Business Standard

Asian Paints Q1 results: Net profit falls 24.5% on weak demand, price cuts

During the quarter, the company's net sales stood at Rs 8,970 crore and were down 2.3 per cent due to weak demand conditions, which the company attributed to general elections and severe heat waves

•

Wed, Jul 17, 2024

Business Standard

Asian Paints Q1 results: Net profit falls 24.5% on weak demand, price cuts

During the quarter, the company's net sales stood at Rs 8,970 crore and were down 2.3 per cent due to weak demand conditions, which the company attributed to general elections and severe heat waves

•

Wed, Jul 17, 2024

Mint

Stock market holiday: NSE, BSE to remain shut today on account of Muharram 2024

Stock market holiday: Indian stock market closed today for Muharram 2024, no trading on NSE or BSE. Commodity market to resume at 17:00 IST. During the day, twenty-two firms, including Asian Paints Ltd, LTIMindtree Ltd, Hathway Cable, and Elecon Engineering, would announce their Q1FY25 results.

•

Wed, Jul 17, 2024

Business Line

Sensex, Nifty updates on 16th July, 2024: Sensex and Nifty have been on a record-breaking run since Friday as foreign investors have turned buyers in the Indian equities ahead of the presentation of the Union budget for 2024-25. Encouraging quarterly results by blue-chips have also supported the rally despite high valuation concerns, according to analysts. Top gainers include, Hindustan Unilever, Bharti Airtel, Tech Mahindra, Infosys, Mahindra & Mahindra, ICICI Bank, ITC and Asian Paints. Top losers include, Kotak Mahindra Bank, Reliance Industries, NTPC, UltraTech Cement and Power Grid. Foreign Institutional Investors (FIIs) bought equities worth ₹2,684.78 crore on Monday, according to exchange data. On Monday, the BSE benchmark climbed 145.52 points or 0.18 per cent to settle at a new record high of 80,664.86. The NSE Nifty rallied 84.55 points or 0.35 per cent to settle at an all-time closing high of 24,586.70.

•

Tue, Jul 16, 2024

The Economic Times

Asian Paints, Tata Steel among 5 stocks with short buildup

A short buildup is when there is a rise in open interest and volumes along with a decrease in the price of the underlying stock in the Futures and Options segment.

•

Mon, Jul 15, 2024